Fixed Income Flash – Brexit

Clear Victory for “Leave”

The results from yesterday’s referendum in the UK on continued EU membership indicate a clear victory for the “Leave” camp despite leaders from both major parties supporting the “Remain” campaign. Prime Minister David Cameron pledged to resign following the selecion of a new Conservative party leader. That new leader will negotiate Britain’s exit from the EU under Article 50 of the EU charter. Once the UK invokes Article 50, it will have two years to negotiate the terms of leaving. The BOE, ECB and Fed all pledged to keep swap lines with each other open and to provide liquidity to deal with any funding pressures that result from the outcome of the referendum.

Risk-Off Market Reaction

Risk-Off Market Reaction

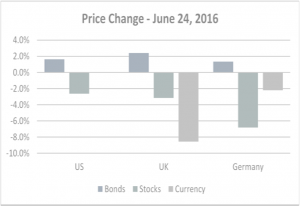

Markets had a severe risk-off reaction to the referendum results. Stocks were down, government bonds were up, and the pound declined against the dollar and the Euro. Some of this movement is the unwinding of positions established recently in anticipation of a “Remain” victory, but much of it is a strong reaction to the possible negative consequences.

What Now?

The most important immediate result is that the uncertainty present in the period leading up to the vote has been increased and will continue for the foreseeable future. This increased uncertainty merits some risk-off market reaction, but today’s moves seem overdone, especially since the key central banks are aggressively working to fulfill their lender of last resort roles. The central bank actions should be sufficient to prevent a financial crisis brought on by sudden capital flight from the UK or the EU periphery.

Beyond the immediate effects, the referendum result will set in motion a series of negotiations among the UK leadership, which will change, and the leadership of the EU and its member nations. These negotiations will involve many constituencies with differing agendas, and their outcome is difficult to predict. The most important things to watch in these negotiations will be whether or not the UK is willing to allow labor migration from the EU in order to maintain access to the European Common Market and the extent to which the EU wants to make leaving harmful to Britain’s economy in order to discourage other EU members from leaving as well. The citizens of both the EU nations and the UK will be best served by an agreement that preserves the free flow of labor, goods and capital between the UK and the EU, but political agendas on both sides of the negotiations will work against that outcome.

While an unfavorable outcome to the Article 50 negotiations would result in slower global growth and some localized economic dislocations, the referendum result is unlikely to be a threat to the stability of the global financial system or to result in a global economic contraction. Investors should be far more concerned about Japan’s fiscal situation, overcapacity and debt growth in China, the unresolved debt crisis in the Eurozone periphery, the long-term fiscal trajectory of the United States and the distortions caused by central bank policies.

This post is printed with the permission of Reinhart Partners, Inc